Stripe vs Paypal, which one should you choose?

You may have a spectacular eCommerce store, but it won’t be very successful if you don’t have a payment gateway that offers a seamless and trustworthy customer experience. Even though there are plenty of payment gateways, Stripe and PayPal are known to be two of the easiest ones to use.

These two gateways have a duopoly in the market, but PayPal dominates with a 59.24% of market share. Stripe has a market share of 14.7%.

Both of these payment gateways offer a lot of features, many of which are pretty similar. However, there are still a few areas where each platform has an edge — This is where this guide will come in handy.

Let’s get to the bottom of the Stripe vs PayPal question.

Stripe vs PayPal – What Can They Do?

Both Stripe and PayPal serve as payment processors for online merchants and many commercial users. In simple terms, these gateways are messengers that pass information between merchants and banks.

The use of Stripe is growing rapidly. This payment gateway is mostly used by people who are more tech-savvy, or merchants that have a team of in-house developers that can make the most of its customizable development tools. It is also one of the most popular picks for small businesses, but larger organizations use it too.

Indisputably though, PayPal is the reigning champion with over 21 million merchants. Almost everyone has a PayPal account in the USA and it’s the most recognizable and trustworthy name in the eCommerce space.

So, what are these payment gateways used for? First of all, eCommerce stores require payment gateways to process payments. Additionally, you can use these gateways to pay for eCommerce plugins. They can even be used to transfer donations to organizations. For example, UNICEF uses payment gateways to accept donations.

Stripe vs PayPal – What’s Right for My Business?

Even though both Stripe and PayPal are good choices for processing payments, both of them have advantages and limitations.

Some key points that we will discuss here include:

- Ease of Use

- Fees

- Accessibility

- Accepted Payments

- Features

- Help & Support

Ease of Use

Both Stripe and PayPal are very easy to use. Customers find it convenient and simple to make payments online. However, as a merchant, setting up the gateways is a bit of a different process.

Stripe: Stripe’s API is one of its strongest selling points. It also supports several content management systems and can easily be integrated with most eCommerce platforms. Stripe uses API keys to validate requests and offers official libraries for programming languages as well as mobile platforms. Merchants have the option to custom code their features, clone an existing project, or follow the detailed guides to build a gateway.

For developers, this tool is not hard to use as they can integrate the gateway using the API. However, if you want to embed features like the Pay With Card button, this will require coding knowledge. Anything besides simple integrations can be pretty tricky for everyday eCommerce store owners. Luckily, there is a Stripe plugin available.

PayPal: Although PayPal also offers development tools, it is primarily designed to be user-friendly. This means anyone can set it up and start taking payments. The platform allows you to integrate with various eCommerce platforms with a few clicks or even create your own site with payment buttons.

All you need to do is copy and paste a few lines of code onto your site to see a Pay with PayPal button, which will allow you to accept online payments. Additionally, you can also add more buttons like Add to Cart, Subscribe, Buy Now, and Automatic Billing.

PayPal also supports almost all content management systems.

Verdict: PayPal takes the cake when it comes to ease of use. However, Stripe isn’t exactly a nightmare to set up and integrate with your site.

Want to set up an eCommerce store? Take a look at Shopify vs WordPress.

Fees

Stripe and PayPal both allow you to display your products without any fees. This means if none of your products get sold, you won’t have to pay a single cent. Payment is only required when you make a sale.

This is good news for small companies or startups that don’t make sales often and don’t want to contend with monthly charges on their already strained budget. Beyond that, Stripe and PayPal both have similar base fees.

Stripe: The base card charge fee for Stripe is 2.9% + $0.30. This means if you make a sale of $50, you will have to pay $1.75.

However, when it comes to international transactions, Stripe will charge an additional 1% fee along with its $0.30 fixed fee. As far as microtransactions are concerned, Stripe says to contact their representatives. This is a pretty clear hint that not all merchants qualify for microtransactions and some negotiation is likely involved.

PayPal: PayPal has the same base fee as Stripe at 2.9% + $0.30. However, it levies a fee of 4.4% of the transaction amount, plus a fixed fee based on the currency.

In addition, PayPal offers you a clear formula to calculate your micropayments (any payments below $10).

If your account is in the US, you pay a fee of 5% of the transaction amount, plus the fixed fee.

If your account is outside of the US, you have to pay 6.5% of the transaction amount, plus the fixed fee.

Besides that, PayPal gives you a lot of in-depth information on how it calculates cost. You can view fees for:

- Standard US and international transaction fees

- Standard US and international transaction fees for charities

- A list of all the fixed fees based on currency

- US and international microtransaction fees

- A list of all the fixed fees for micropayments based on currency

- A list of Pro, Virtual and American Express fees

- Chargebacks and refund fees

- Mobile card reader fees

- Mass Pay fees and so on

For a summarized version of the different fees, take a look at the chart below:

| Service | PayPal | Stripe |

| US standard transaction fees | 2.9% + 30c | 2.9% + 30c |

| International standard transaction fees | 4.4% transaction amount + fixed fee | 1% transaction amount + fixed fee |

| Micropayments (US) | 5% + 5c | Contact sales |

| Refund fees | No refund fees, original fees will not be returned | No refund fees, original fees will not be returned |

| Chargeback fee (US) | $20 | $15 |

| American Express | 3.5% per transaction | Same flat rate |

For more on merchants fees, visit https://stripe.com/pricing and https://www.paypal.com/us/webapps/mpp/merchant-fees

Verdict: Based on this, a lot of people will vote for PayPal due to its high level of transparency. Stripe levies a lower international transaction fee, but keeps its micropayment fees hidden. Plus, contacting a customer representative may seem like a hassle to some.

Accessibility

If you want to take your business global, you will require a really good payment gateway that will offer you the right kind of support. Let’s see which one is best for you:

Stripe: Stripe is only available in 36 countries. For many businesses, this can be a deal-breaker. However, you can easily work around this issue by using Atlas, which will allow you to incorporate a US company, set up a US bank account, and start accepting payments.

However, the area in which Stripe shines is currency support. Stripe supports over 135 different currencies.

PayPal: PayPal, on the other hand, accepts payment from over 200 countries. However, it only supports 25 currencies. Additionally, it also restricts its services in countries like Belarus.

So no matter where your business is registered, you can set up a PayPal account and start processing payments.

Verdict: Since currency support is more important than available currencies, PayPal has a bit of an edge over Stripe. However, we will say that Stripe has been here for a shorter length of time and is playing catch up when it comes to availability in countries.

Accepted Payments

PayPal and Stripe both offer strong payment method options.

Stripe: The great thing about Stripe is that it offers a huge number of payment methods, including every major type of credit and debit card in multiple countries. It also works with wallets like Alipay, Amex Express Checkout, Apple Pay, Google Pay, Microsoft Pay, Masterpass by MasterCard, Visa Checkout, and WeChat Pay. There are also several local payment options available.

Although these payment methods already give Stripe an edge over PayPal, the ones that stand out the most are Visa and MasterCard, which claim an 80%+ market share.

Being able to use their native wallets is definitely a huge bonus for eCommerce stores.

PayPal: PayPal also accepts every major credit card and payment method that users can store, including eChecks. However, it also boasts PayPal Credit, which is a virtual reusable credit line that PayPal extends to all its US accounts. Through this line of credit, which is exclusively provided by Synchrony Bank, PayPal can reach a huge base of merchants who are looking for special financing.

Verdict: Even though Stripe offers an extensive line of card and wallet payment options, PayPal Credit can tip the scales in favor of PayPal if the majority of your customers live in the US.

Features

Here are some of the most notable features offered by each payment gateway:

Stripe: Unlike PayPal, Stripe does not offer a lot of service plans and your access remains the same, no matter what tools and features you use. Stripe’s payment processing tools include:

- Stripe Elements: A custom UI option that gives merchants the ability to create custom payment forms from scratch using any device.

- Embeddable Checkout: A pre-built payment form that can be embedded and used on your website.

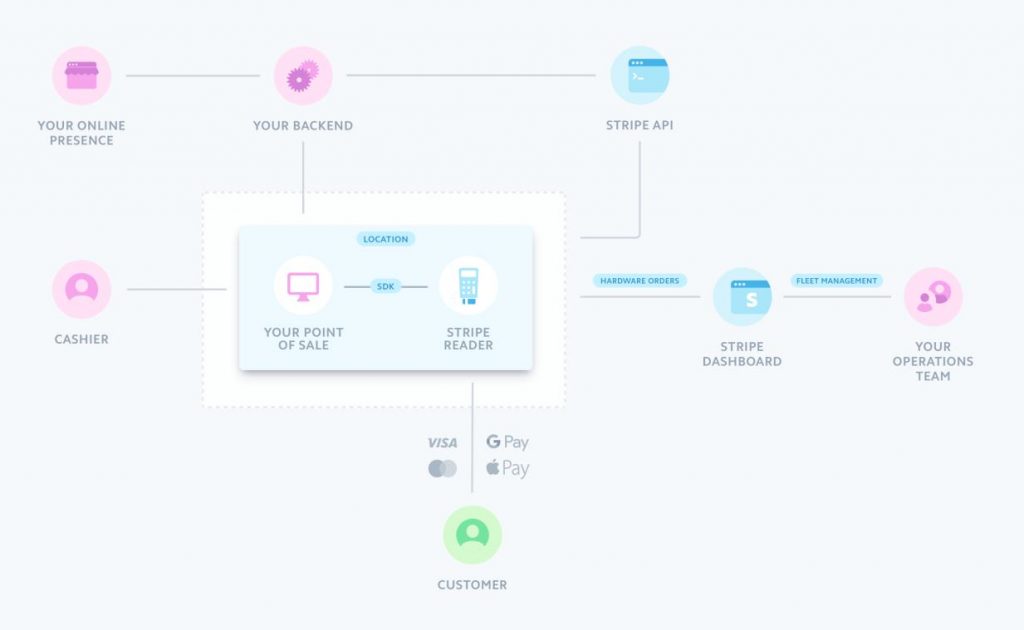

- In-Person Payments: Stripe offers several mobile card readers and terminals that allow you to accept in-person payments.

- Stripe Billing: With this toolkit, you can send custom invoices and request payments from your customers. It also handles recurring billing, schedules payment, and includes subscription tools.

- Stripe Issuing: This feature is made for eCommerce businesses that want to generate physical and virtual cards, such as employee expense accounts. However, this is only available in the US.

- Stripe Radar: This feature offers advanced fraud-detection and prevention capabilities by analyzing your data; including payments, checkout flows, and financial partners, and stopping potential fraud cases.

- Stripe Relay: This API allows you to make in-app purchases.

- Stripe Sigma: This feature allows businesses to analyze data using SQL to improve business efficiency.

- Stripe Connect: This is a payment option for large marketplaces to accept money and pay third parties. It is used by Kickstarter and Lyft.

- Stripe Terminal: This is an SDK that can help you build your own point of sale system. It also comes with additional features and pre-certified hardware.

- Stripe Atlas: This is a startup tool guide that enables you to set up a company, establish IP ownership, get a tax ID number from the IRS, and set up a new bank account and debit card for your business, no matter where you are in the world.

- Stripe Sources: This API allows you to accept payment methods from all over the world.

Keep in mind, though, that you need development skills to start using these tools. They aren’t made for people without coding experience.

PayPal: As you can see, Stripe offers a whole host of highly customizable features. However, PayPal offers almost the same number of simple, but very powerful solutions. Even though global payments are PayPal’s forte, merchants also get several supplemental service plans. These include:

- PayPal Checkout: You can add this option to your payment pages if you already accept credit card payments through another payment processor or eCommerce integration. It will give your customers an option to check out with PayPal, PayPal Credit, and Venmo, based on user data.

- Payments Standard: In the Standard Plan, PayPal becomes your primary payment processor. It can help you build your payment buttons and add features like a shopping cart. It also does not require a lot of coding knowledge.

- Payments Pro: This includes all the features of Payments Standard, plus a hosted checkout page and virtual terminal for a monthly fee and some processing cost.

Some other features that PayPal offers include:

- Payflow Pro: This is PayPal’s proprietary payment gateway with which you can create a hosted checkout page. It also allows you to accept major credit cards as well as foreign payment methods. The funds typically arrive within 48 hours and you can enjoy features that help you manage recurring billing, buyer authentication, and fraud protection.

- PayPal Here: PayPal’s mobile payment option enables you to accept payment in person by processing credit/ debit cards with a mobile reader card.

- PayPal Payouts: This feature allows you to send payments in bulk to up to 5,000 people at once.

- Payflow Link: Payflow Link has no monthly cost but allows your customers to check-out on a PayPal hosted template rather than a template on your own website.

As you can see, PayPal has a lot of developer tools too, which may not be as high-tech as Stripe’s, but still offers customers the solutions they need. If you have a developer at your disposal, it can be a breeze to use these tools.

Verdict: PayPal’s developer tools don’t even come close to what Stripe offers. Stripe definitely provides the gold standard, particularly in terms of APIs and tool kits. So, if you have the skills to use them, Stripe offers a whole lot more customizable features than PayPal.

Another alternative worth considering? Read Our Guide On Payoneer

Help & Support

No matter what service you use, customer support is crucial. If you have an issue with your transactions, you cannot wait for hours or days to have it solved. Let’s look at the customer support features that Stripe and PayPal offer:

Stripe

- Live Support: Stripe users can benefit from free 24/7 live support

- Phone Support: You can choose to wait to speak to a support agent or ask Stripe to call you back

- Email Support: If your request isn’t urgent, you can send the Stripe customer support team an email

- Knowledgebase: The Stripe knowledge base also covers all the basics

- Developer Documentation: Even if you’re not code-savvy, this documentation can help you learn about all the features you can use. It is much more extensive than the knowledge base, but focused towards developers

- IRC Chat: The IRC chat can help you reach Stripe’s developers to get answers to technical questions

PayPal

- Phone Support: PayPal does not offer 24/7 live support like Stripe. Its phone hours are 9 am to 5:30 pm. This is due to the large number of PayPal customers

- Email Support: If your question isn’t pressing, you can send PayPal an email and wait for their reply

- Help Center: The PayPal help center has a knowledge base that answers frequently asked questions about accepting payments, getting refunds, and other processes

- Community Forum: The community forum can help you find solutions to commonly asked questions and offers technical support. You can also find out if others are facing the same issues, do your own troubleshooting and learn how to work around a missing feature

- Developer Center: Although the documentation isn’t as extensive as Stripe, you can still find a lot of information about how to customize different features. Like Stripe, it is also developer-focused

Verdict: Stripe wins because of their live chat feature and extensive developer documentation.

However, just because Stripe and PayPal both have multiple channels for help and support, it doesn’t mean that their customer service is actually good. Although both strive to make it easy for customers to reach them, they both struggle to offer consistent and strong customer support. This may be because giving valuable customer support to millions of customers is extremely difficult.

Interested in how we started out business? Read this article

Stripe vs. PayPal: Which One Is Better?

Although both Stripe and PayPal have a lot of features, there are certain aspects that set them apart from each other.

PayPal has several features that provide added value to US-based accounts, like PayPal Credit. It is clearly better for businesses that have fairly standard eCommerce needs. Although the hosted payment page is available with the $30/month subscription package, it is offset by the fact that PayPal has a high level of customer trust. Additionally, you also get many free features such as the mPOS app, invoicing capabilities, customizable buttons, and more.

However, if you are comfortable with coding and want to build a highly customized storefront, then Stripe’s developer tools can fulfill your needs. However, if you like everything else that PayPal offers, there is no reason why you can’t use its developer’s tools too.

Ultimately, the decision depends on what kind of business you are running and what aspects you prefer in your payment processing gateway. If you are still struggling to decide between the two i’d also consider looking at Payoneer.

In my online businesses i’ve used Paypal more than i’ve used Stripe, but this of course is specific to my personal set up, you’ll need to find the right solution for you.

I hope you’ve found this article useful, if you want to learn more about how to set up a successful eCommerce store, take a look at our guide on Shopify. It’s the best option I’ve found when it comes to eCommerce, if you are a regular reader here you’ll know i talk about it a lot.

Good Luck and let me know if you have any questions!

from eBusiness Boss https://ift.tt/2USuK8M

0 Comments